The Transcendent Power of Health Insurance

Is reality real? Is choice? What does insurance have to do with it?

Is our old friend Morpheus right? When it comes to bodily autonomy, I tend to agree: More than the government, God, the Matrix, or any political party, it is the insurance industry which actually has the most control.

The subordination of the medically recommended courses of action to the preferences of insurance providers happens almost every step of the way for almost all medical issues and most of us are powerless to prevent it. I call this the ‘Bureaucracy and Bills’ approach to hijacking bodily autonomy.

THE SAMPLE: Each morning, The Sample sends you one article from a random blog or newsletter that matches up with your interests. When you get one you like, you can subscribe to the writer with one click. Try it out, here.

I’ve been suffering from a chronic form of back pain since 2018. The pain starts on the back right side, just above my pelvis, and it radiates down the right side of my right leg, along the IT band, to my knee. Sometimes it tingles, other times, just aches. I’ve seen two doctors about the pain. The first was useless: After getting an x-ray, he spent 60 seconds with me in an exam room, didn’t make eye contact, and diagnosed me with muscle spasms. I got some ineffective muscle relaxers and a prescription for physical therapy. After 9 months of both with no signs of improvement, I gave up.

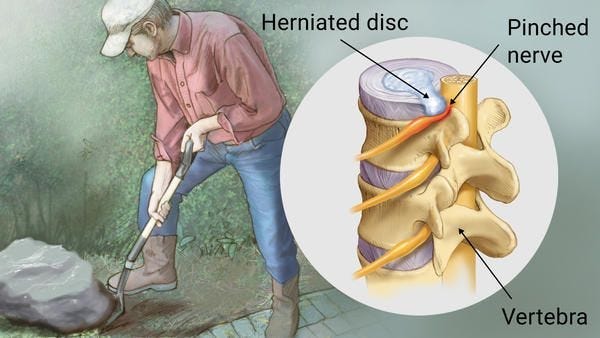

The second doctor, seen in 2022 after I decided perhaps I shouldn’t live the rest of my years with back pain, surmised I may have a herniated disc with a pinched nerve.

To confirm her suspicion and to see if my body resembled something like the image above, she needed a way to see not just my bones, but my tissues and muscles as well. She needed to see an MRI.

Simple and straightforward, go off Queen!

If only the execution were as simple as the plan itself. To be eligible for an MRI, I first had to complete 6 weeks of twice-weekly physical therapy. Upon proven completion, my doctor could ask permission from Aetna—my insurance provider—if I was allowed to receive an MRI. All of a sudden, my insurer, like the guy who orders appetizers for everyone at the group dinner, had forced me into medical care without input from the doctor I’d chosen to see.

In my case, and almost all others like it, the industry wields its vast bureaucracy and the high cost of raw, uninsured medical care against patients to limit or outright eliminate their ability to care for themselves in the most expedient and effective way. This is done mostly in the interest of cost savings.

In the context of my back issue, I was left with a choice: proceed with the MRI immediately (both the doctor’s preferred choice and the quickest way to diagnose my issue), or wait at least a month a half (after doing the mandated six weeks of physical therapy) to get an MRI.

Had I chosen to get an MRI without permission, I’d have opened myself up to a ‘denial of claim’ from my provider (bureaucracy) and the cost of an uninsured MRI ranging between $400 and $5,000 (bills).

In 2020, the most recent year of data, about 18% of in-network claims from qualified healthcare plans offered on Healthcare.gov were denied. While this data doesn’t encompass all claims, it’s enough of a sample to understand just how often claims are denied. Below are the reasons for denial offered by insurers and the percentage of total denied claims they represent:

Once denied, it could take months for the appeal process to conclude. This is assuming one’s inclined enough to sort through the opaque terminology, the paperwork, complicated instructions, and requisite phone trees to even file an appeal. On one side, you have yourself and the limitations of your own free time, and on the other, multi-billion dollar corporations with millions of off-shored help-line operators and paperwork administrators. I’m not alone in thinking this:

Of the more than 42 million denied in-network claims in 2020, marketplace enrollees appealed fewer than 61,000 - Claims Denials and Appeals in ACA Marketplace Plans in 2020, Jul 05, 2022

As for bills, it’s not just MRIs that are expensive:

Fixing a broken leg can cost up to $7,500

The average cost of a 3-day hospital stay is around $30,000

If it’s not the threat of bureaucracy that gets you, the threat of unmitigated bills will.

Philosophically, insurance operates in the aggregate:

What’s the most cost effective course of action for all people who might need an MRI?

It’s no wonder this system doesn’t work. In order to be effective, care must be bespoke. In order for insurance to be effective, everyone with a back issue is lumped into a faceless cohort with a predetermined medical path.

So before you go trying to jack out of the Matrix, remember it’s not God’s plan you’re following, it’s Humana’s.

Do you have my back? Not yet? Subscribe.